Thinking of moving up in Vancouver’s 2025 market? Prices aren’t crashing, rates have stabilized, and the market is balanced. Get straight answers on prices, mortgage rates, sale-to-active ratios, and new developments—so you can act with confidence.

Here’s a quick, no-fluff guide to the most talked-about questions in Vancouver real estate right now—so you can make a confident decision about your next move.

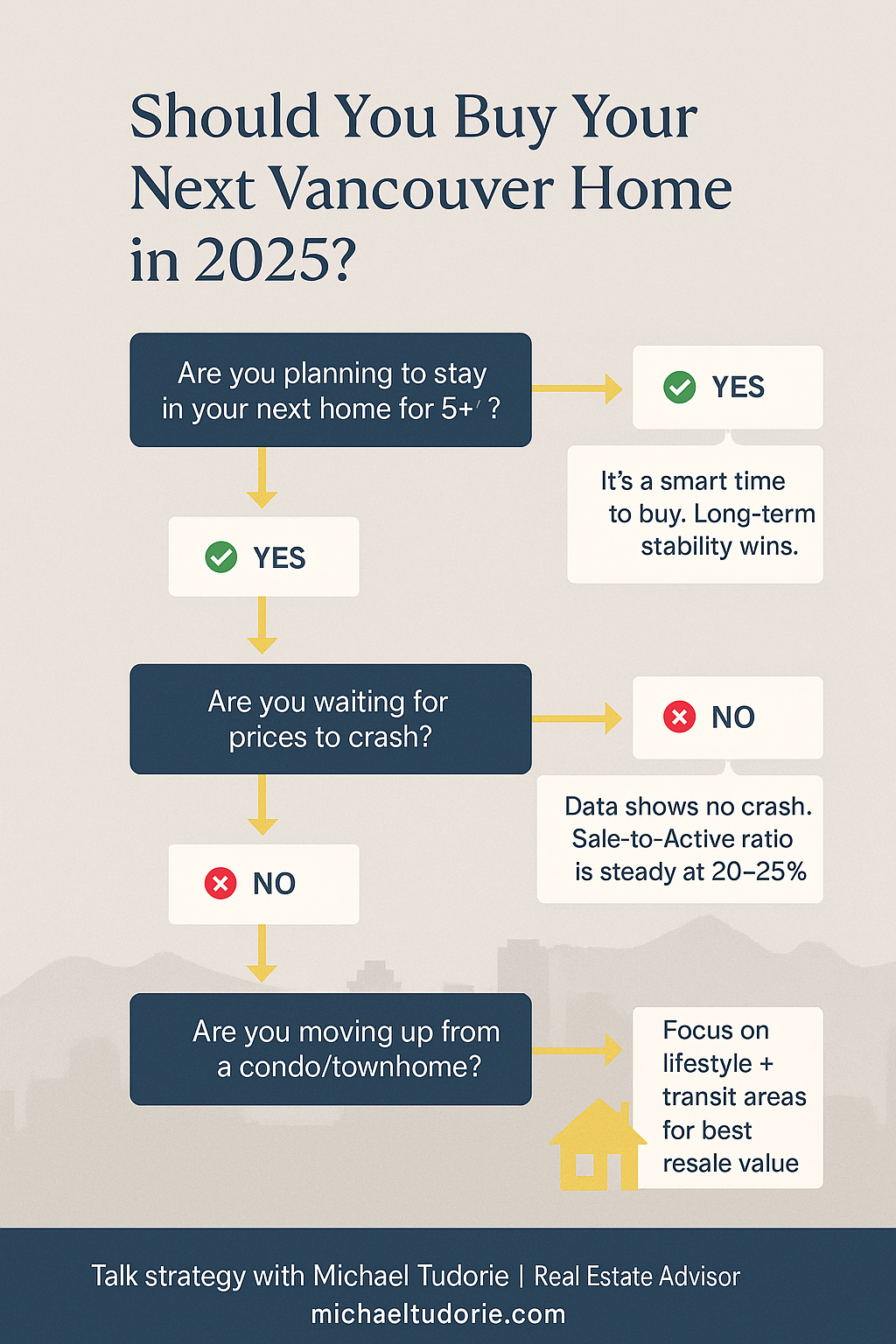

Q1. Should I buy in 2025, or wait for prices to drop?

This is the #1 question I hear. Here’s the reality: No crash coming. The sale-to-active ratio is holding steady in the 20–25% range, a balanced market that supports stable prices.

Rates are predictable. After years of swings, interest rates have levelled off—giving buyers more certainty.

Rare upsizing window. The price gap between condos/townhomes and detached homes hasn’t widened as much as before, making it easier to move up now than in the past.

👉 If you’re planning to stay in your next home for 5+ years, the smart move is to buy strategically—not wait on the sidelines.

Q2. How do mortgage rates, pricing, and supply shape today’s market?

Think of these three levers as the market’s engine:

Mortgage rates: Stability has brought buyers back. You can plan around predictable payments.

Pricing trends: Modest increases are expected, not wild swings.

Supply constraints: Even with new zoning rules, immigration and demand keep inventory tight.

Bottom line: Rates + low supply = steady demand. That’s why Vancouver prices hold their ground.

Q3. Can I buy before I sell my current home?

One of the hottest questions online right now. The short answer: Yes, but plan carefully.

Pro: You secure your dream home without missing out.

Con: Carrying two mortgages can stretch your finances.

Smart play: Use bridge financing or negotiate longer possession dates to ease the transition.

👉 Curious how this could work in your case? Let’s talk through your numbers before you commit.

Q4. What about all the new developments and rezoning—do they affect resale?

Absolutely. The city is changing fast, and that impacts your investment:

Broadway Plan: Lots new homes along the corridor = future density + amenities.

Zoning reform: Single-family zones are giving way to duplexes and multiplexes—more upgrade paths for buyers.

Transit growth: SkyTrain expansions (UBC, Broadway, Surrey–Langley) make homes near stations future-proof for resale.

Q5. What’s the smartest move for buyers and sellers right now?

For Buyers: Don’t wait for a crash that data doesn’t support.

Negotiate, include inspections, and take advantage of today’s calmer pace.

Target rezoned or transit-oriented areas for long-term upside.

For Sellers: Staging, video, and sharp pricing still matter most.

Be flexible on terms—buyers value breathing room in 2025.

2025 isn’t about gambling on headlines—it’s about making thoughtful, lifestyle-driven decisions in a balanced market.

If you’re a professional looking to move up, this year gives you something rare: time to think, space to negotiate, and a market that rewards smart planning.

Q1. Should I buy in 2025, or wait for prices to drop?

This is the #1 question I hear. Here’s the reality: No crash coming. The sale-to-active ratio is holding steady in the 20–25% range, a balanced market that supports stable prices.

Rates are predictable. After years of swings, interest rates have levelled off—giving buyers more certainty.

Rare upsizing window. The price gap between condos/townhomes and detached homes hasn’t widened as much as before, making it easier to move up now than in the past.

👉 If you’re planning to stay in your next home for 5+ years, the smart move is to buy strategically—not wait on the sidelines.

Q2. How do mortgage rates, pricing, and supply shape today’s market?

Think of these three levers as the market’s engine:

Mortgage rates: Stability has brought buyers back. You can plan around predictable payments.

Pricing trends: Modest increases are expected, not wild swings.

Supply constraints: Even with new zoning rules, immigration and demand keep inventory tight.

Bottom line: Rates + low supply = steady demand. That’s why Vancouver prices hold their ground.

Q3. Can I buy before I sell my current home?

One of the hottest questions online right now. The short answer: Yes, but plan carefully.

Pro: You secure your dream home without missing out.

Con: Carrying two mortgages can stretch your finances.

Smart play: Use bridge financing or negotiate longer possession dates to ease the transition.

👉 Curious how this could work in your case? Let’s talk through your numbers before you commit.

Q4. What about all the new developments and rezoning—do they affect resale?

Absolutely. The city is changing fast, and that impacts your investment:

Broadway Plan: Lots new homes along the corridor = future density + amenities.

Zoning reform: Single-family zones are giving way to duplexes and multiplexes—more upgrade paths for buyers.

Transit growth: SkyTrain expansions (UBC, Broadway, Surrey–Langley) make homes near stations future-proof for resale.

Tip: Buy for lifestyle today, but keep an eye on transit and zoning for tomorrow’s value.

Q5. What’s the smartest move for buyers and sellers right now?

For Buyers: Don’t wait for a crash that data doesn’t support.

Negotiate, include inspections, and take advantage of today’s calmer pace.

Target rezoned or transit-oriented areas for long-term upside.

For Sellers: Staging, video, and sharp pricing still matter most.

Be flexible on terms—buyers value breathing room in 2025.

Final Word: Strategy Beats Timing

2025 isn’t about gambling on headlines—it’s about making thoughtful, lifestyle-driven decisions in a balanced market.

If you’re a professional looking to move up, this year gives you something rare: time to think, space to negotiate, and a market that rewards smart planning.

📞 Call me at 604-910-7777 or visit michaeltudorie.com

to book a strategy session. Let’s map out your move with clarity and confidence.