Vancouver’s market has more listings but less confidence. Here’s what buyers and sellers need to know before deciding whether to move or wait.

Vancouver’s market has more listings but less confidence. Here’s what buyers and sellers need to know before deciding whether to move or wait.What’s Really Happening in Vancouver’s Market Right Now

If you’ve been wondering whether it’s a good time to buy or sell in Vancouver, you’re not alone. The market feels contradictory—inventory is rising, prices are softening, yet open houses are busy again.

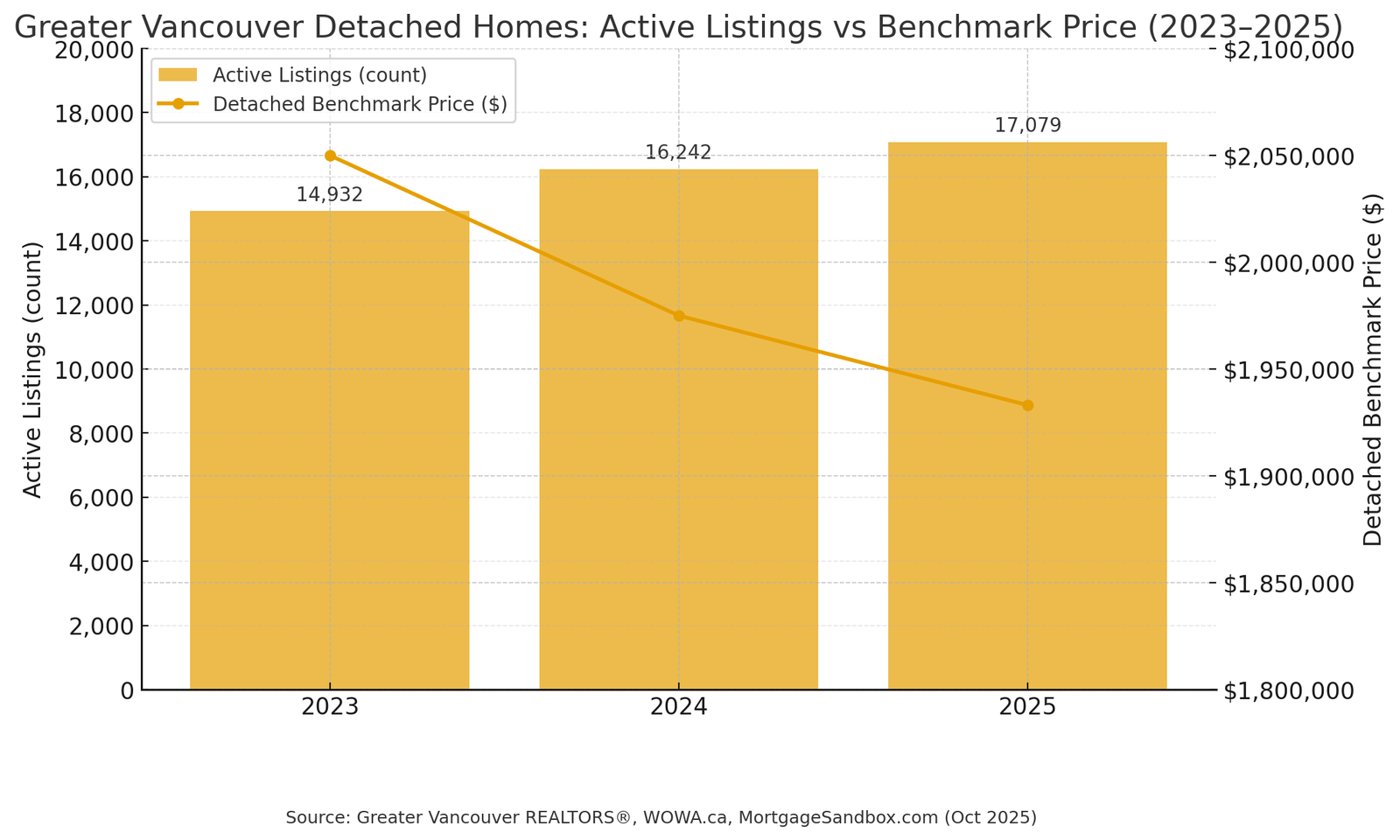

As of September 2025, Metro Vancouver had 17,079 active listings, up 14% from a year ago and well above the 10-year seasonal average. The sales-to-active-listings ratio sits around 46%, signalling a balanced market—neither buyer nor seller has the upper hand. Detached prices are down about 4% year-over-year, and condo prices have slipped roughly 3%.

Economists at TD Economics and the BC Real Estate Association (BCREA) expect prices to decline slightly , followed by a modest rebound once more rate cuts arrive. That means we’re in a transitional phase: more supply, slower demand, but underlying long-term strength. In short: The market isn’t crashing—it’s resetting.

Why Buyers (and Sellers) Are Hesitant

After years of volatility, it’s understandable that confidence is fragile. Detached prices recently broke below the $1.94 million floor, a psychological milestone that made both buyers and sellers second-guess their next move. Developers have paused new presale launches, further reinforcing the “wait and see” mood.

For buyers, the message has been mixed. Rising inventory suggests choice and leverage, but economic headlines fuel uncertainty. For sellers, the hesitation stems from fear of listing “too soon” or “too low.” Many are stuck in what we call decision paralysis.

Add to that fatigue from contradictory media stories—one week calls it a buyer’s market, the next says bidding wars are back—and it’s no wonder many Vancouverites are frozen in place.

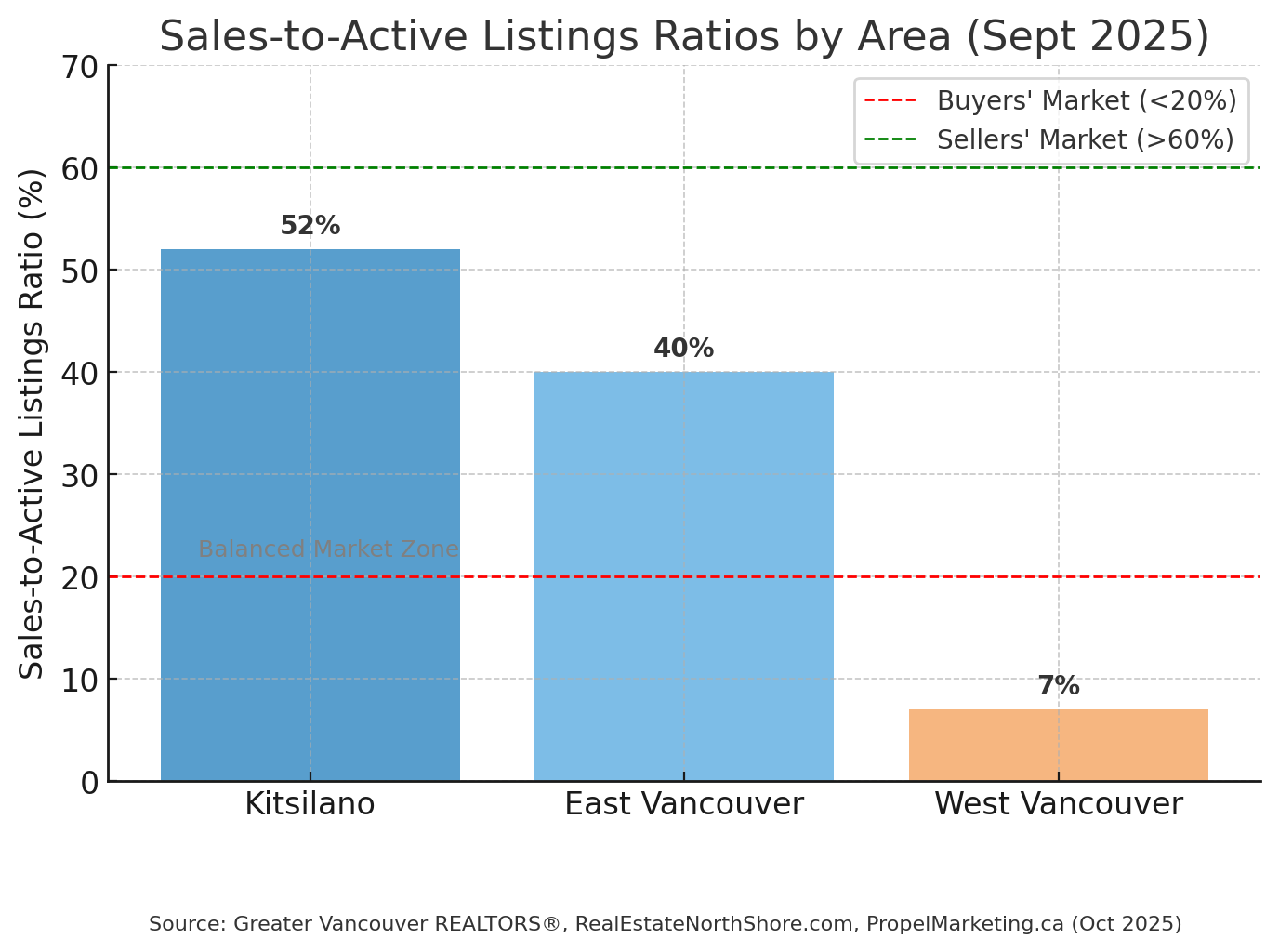

What Local Numbers Reveal: Kitsilano, East Van, and West Van

Markets within Metro Vancouver are moving at different speeds. Understanding these local shifts helps calm the noise and bring focus back to strategy.

Kitsilano: Detached benchmark fell to about $2.61 million earlier in 2025—down 6% year-over-year and roughly 12% below the 2022 peak. Median list price in September 2025 was $1.76 million, with typical homes spending just over three weeks on market. That signals activity, not panic.

East Vancouver: Detached listings jumped 31%, while sales dropped 14%. Condo benchmarks hovered near $685K, down 3%. This area illustrates how inventory is expanding faster than demand—classic conditions for a balanced market.

West Vancouver & North Shore: With a 6.7% sales-to-listings ratio and inventory up more than 20%, high-end properties are clearly in buyer-market territory. Sellers here must lead with realistic pricing and standout presentation.

This is where working with a trusted real estate advisor makes the difference. They bring perspective that algorithms can’t: neighbourhood nuance, buyer psychology, and timing strategy.

Each pocket tells the same story: the market is not collapsing, it’s normalizing.

You currently have more choice and less competition.

Prices are steady or slightly lower, and sellers are more open to negotiation.

Waiting for rate cuts may mean facing tighter inventory and rising prices later.

For sellers:

The market rewards preparation and realism.

Listing now, before the 2026 spring rush, can mean less competition from similar homes.

Even with modest price pressure, serious buyers remain active for well-positioned listings.

Think of today as the calm before the next wave. Acting strategically now often beats reacting later when everyone else jumps in.

What Smart Sellers Are Doing Instead of Waiting

Pricing with precision; Forget BC Assessment—it’s updated once a year and never accounts for your upgrades or current momentum. Pricing too high only helps sell other homes in your area. Your advisor should analyze real-time data and adjust for pros and cons, not rely on last quarter’s comps.

Planning early (3–5 months ahead) The most successful listings begin preparation long before going live. This window allows for minor renovations, staging, photography, and pricing strategy.

Investing in presentation; In this visual, online-driven market, staging and maintenance aren’t luxuries—they’re leverage. A well-presented property justifies its asking price and photographs better, attracting more qualified buyers.

Getting a second opinion; There are many online home-evaluation tools, but most are about as reliable as sushi from a gas station. Consider an independent property-assessment company or a data-driven realtor who blends valuation models with market insight.

Partnering with a strategy-minded agent; Your agent’s job isn’t to “test” the market—it’s to position you to win it. Be wary of anyone who lists too high just to secure your signature and plans to suggest reductions later. Price credibility is currency; once it’s lost, you pay for it in time and money.

The Confidence Gap—and How to Close It

Confidence comes from clarity. When you understand the numbers and your own motivations, the fear of “what if” fades.

If you’re buying, clarity might mean locking in a home that meets your lifestyle instead of chasing the perfect rate. If you’re selling, it’s knowing your home’s market position, not its sentimental value.

Final Thoughts: Time Your Life, Not the Market

The Vancouver real estate market has entered a quieter, more thoughtful phase—one that rewards preparation and long-term perspective over speculation. There’s rarely a single “right” time to buy or sell, but there is a right plan for you. Whether you’re upsizing, downsizing, or just exploring options, now is the time to start that conversation, analyze the data, and align your next move with your life goals.

Ready to understand where your property fits in today’s market? Reach out for a personalized evaluation and strategy session—because in this market, knowledge isn’t just power; it’s peace of mind.

Each pocket tells the same story: the market is not collapsing, it’s normalizing.

Is It a Good Time to Buy—or Wait?

The honest answer depends on your goals, not the headlines.

For buyers:You currently have more choice and less competition.

Prices are steady or slightly lower, and sellers are more open to negotiation.

Waiting for rate cuts may mean facing tighter inventory and rising prices later.

For sellers:

The market rewards preparation and realism.

Listing now, before the 2026 spring rush, can mean less competition from similar homes.

Even with modest price pressure, serious buyers remain active for well-positioned listings.

Think of today as the calm before the next wave. Acting strategically now often beats reacting later when everyone else jumps in.

What Smart Sellers Are Doing Instead of Waiting

Pricing with precision; Forget BC Assessment—it’s updated once a year and never accounts for your upgrades or current momentum. Pricing too high only helps sell other homes in your area. Your advisor should analyze real-time data and adjust for pros and cons, not rely on last quarter’s comps.

Planning early (3–5 months ahead) The most successful listings begin preparation long before going live. This window allows for minor renovations, staging, photography, and pricing strategy.

Investing in presentation; In this visual, online-driven market, staging and maintenance aren’t luxuries—they’re leverage. A well-presented property justifies its asking price and photographs better, attracting more qualified buyers.

Getting a second opinion; There are many online home-evaluation tools, but most are about as reliable as sushi from a gas station. Consider an independent property-assessment company or a data-driven realtor who blends valuation models with market insight.

Partnering with a strategy-minded agent; Your agent’s job isn’t to “test” the market—it’s to position you to win it. Be wary of anyone who lists too high just to secure your signature and plans to suggest reductions later. Price credibility is currency; once it’s lost, you pay for it in time and money.

The Confidence Gap—and How to Close It

Confidence comes from clarity. When you understand the numbers and your own motivations, the fear of “what if” fades.

If you’re buying, clarity might mean locking in a home that meets your lifestyle instead of chasing the perfect rate. If you’re selling, it’s knowing your home’s market position, not its sentimental value.

Final Thoughts: Time Your Life, Not the Market

The Vancouver real estate market has entered a quieter, more thoughtful phase—one that rewards preparation and long-term perspective over speculation. There’s rarely a single “right” time to buy or sell, but there is a right plan for you. Whether you’re upsizing, downsizing, or just exploring options, now is the time to start that conversation, analyze the data, and align your next move with your life goals.

Ready to understand where your property fits in today’s market? Reach out for a personalized evaluation and strategy session—because in this market, knowledge isn’t just power; it’s peace of mind.