Vancouver’s housing market looks a lot like 2019 again. Here’s what that reset means for your 2026 move if you’re thinking about buying or selling.

Why the 2025 Market Feels Like 2019 Again

Homes are sitting on the market around 34 days on average — not flying off in days, not gathering dust for months. That’s classic balanced-market behaviour, very similar to 2019.

Prices aren’t crashing, but they’re also not racing ahead. In many sub-areas, inventory is up, sales are softer, and prices are either flat or gently adjusting.

This creates a different kind of pressure:

Less “fear of missing out”

More time to think, inspect, and negotiate

A bigger penalty for emotional, unrealistic pricing

People love their rate, not the home.

Many owners are staying put because of the ultra-low mortgage they locked in, not because the home still fits their life.

If you’re planning a move in 2026, this reset is your window to plan with a cool head instead of reacting to headlines.

Who’s Actually Buying in Vancouver Right Now?

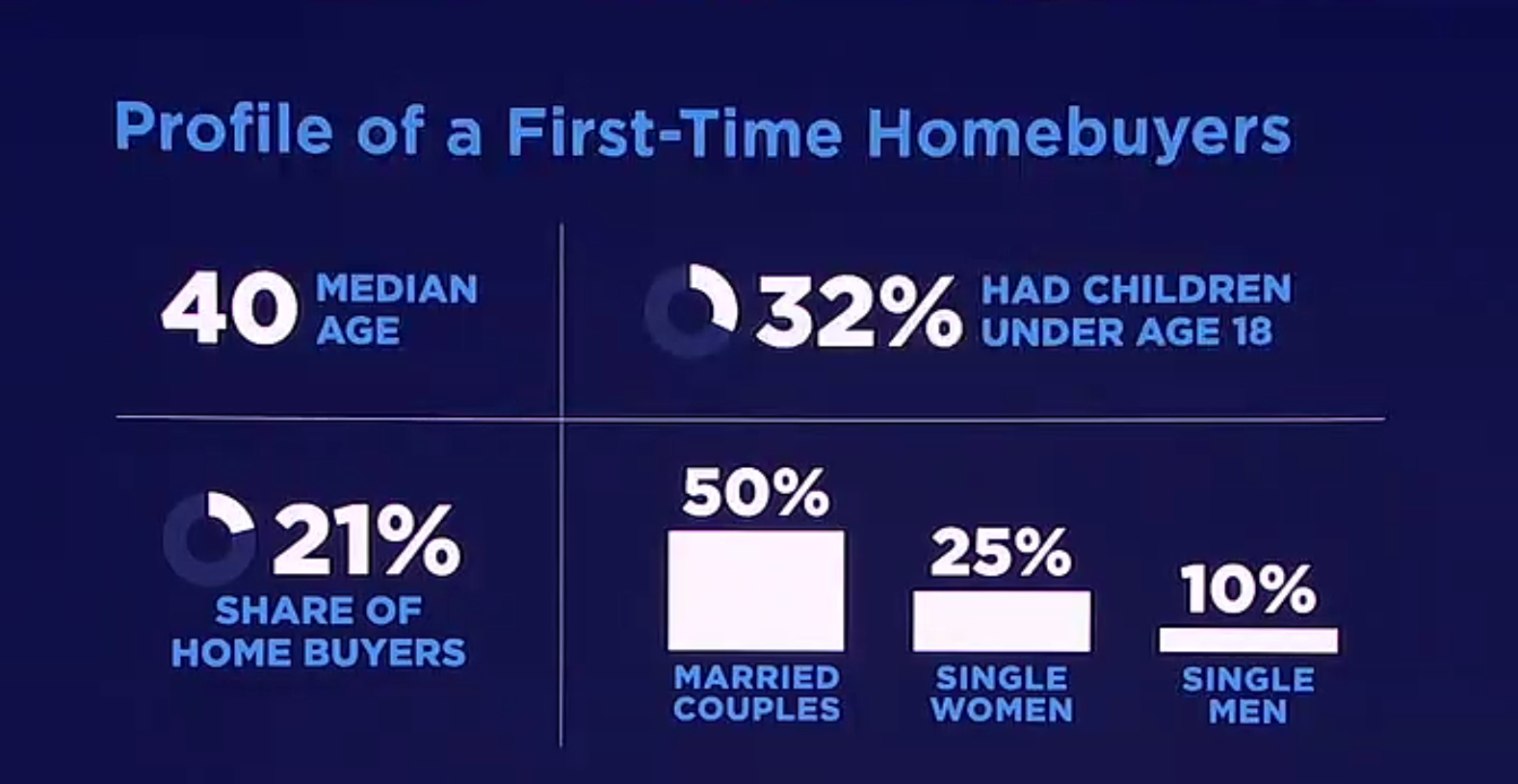

Today’s buyers don’t look like the 2015 or 2019 crowd.

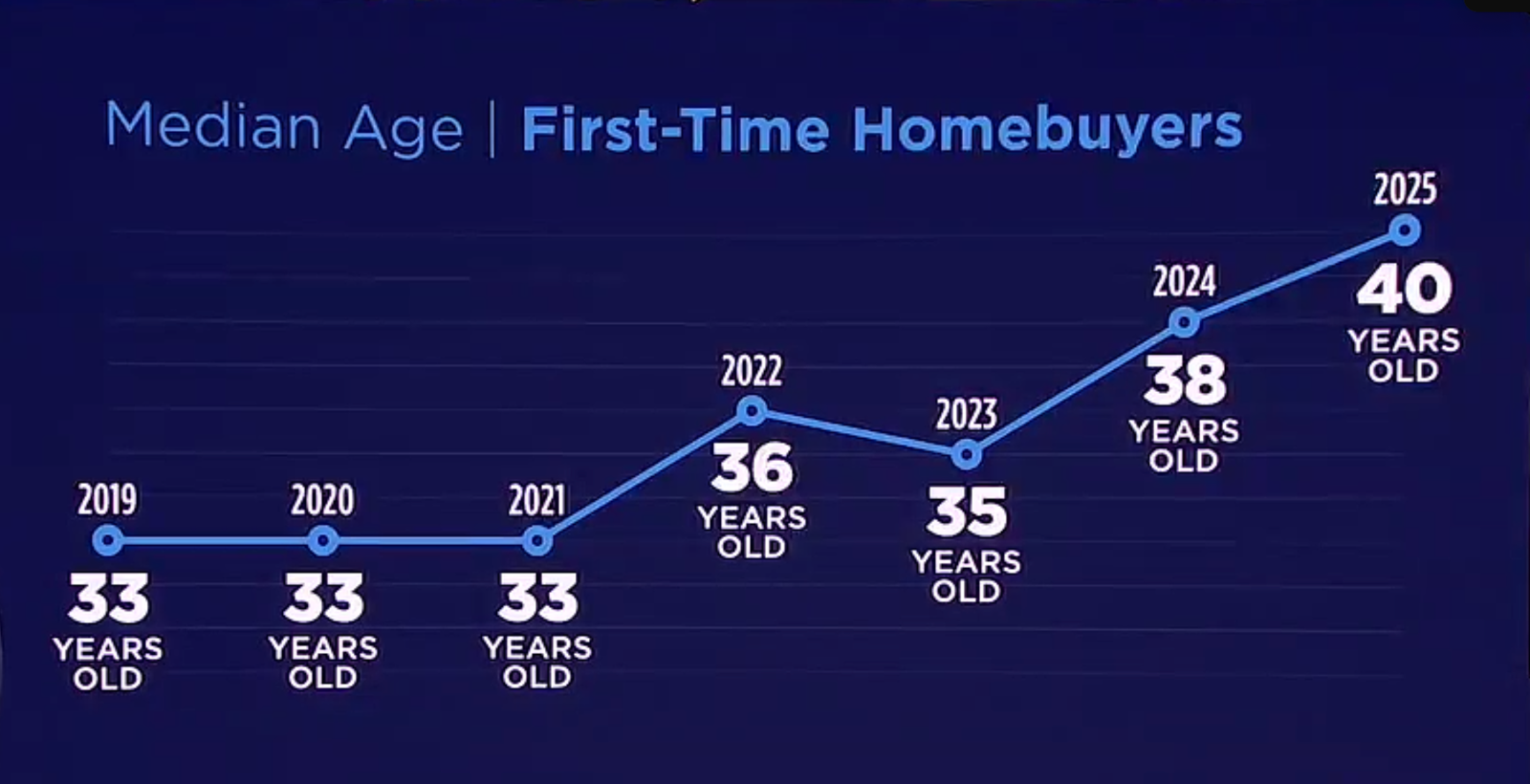

The median first-time buyer is now about 40 (up from the early 30s a few years ago).

Single buyers are a real force — especially single women; They’re not putting a ring on it… they’re putting a doorbell on it.

Many are choosing homeownership before marriage or kids. The order of “life events” has changed, but the goal is the same: security, control, and a place that’s truly theirs.

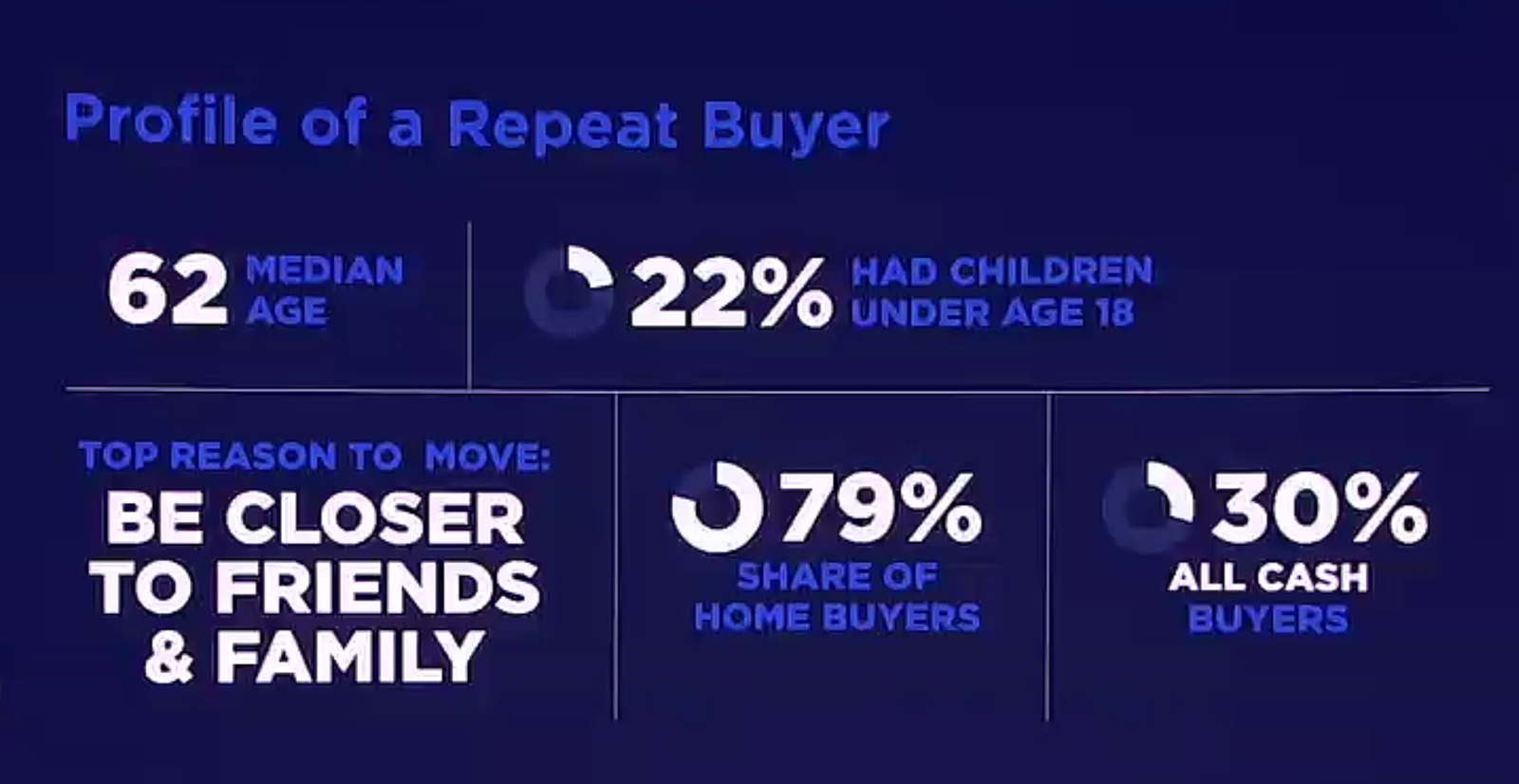

On the other side, repeat buyers look very different:

Median age around 62

Roughly 79% of buyers are repeat buyers

Close to 30% of them are cash buyers

They’re not chasing the market; they’re reshaping their lifestyle — downsizing, moving closer to family, or trading maintenance for convenience.

Stay, Renovate, or Move? The Locked-In Rate Dilemma

A big reason inventory feels tight is simple: People are in love with their mortgage rate, not necessarily their home.

When you’re sitting on a 1.5–2.5% rate, moving to a smaller place at a higher rate can feel like going backwards. So owners ask:

“Do we move, or do we renovate and stay?”

Common plays right now:

Adding a suite for income or aging parents

Finishing basements or attics

Reworking layouts instead of changing addresses

Updating kitchens/baths instead of upgrading neighbourhood

This doesn’t mean nobody will move. It means many will wait until renewal — which is why 2026 is shaping up as a decision year for a lot of households.

Multi-Generational Living: Smart Strategy or Stress Test?

Multi-generational living is no longer niche. It’s showing up because:

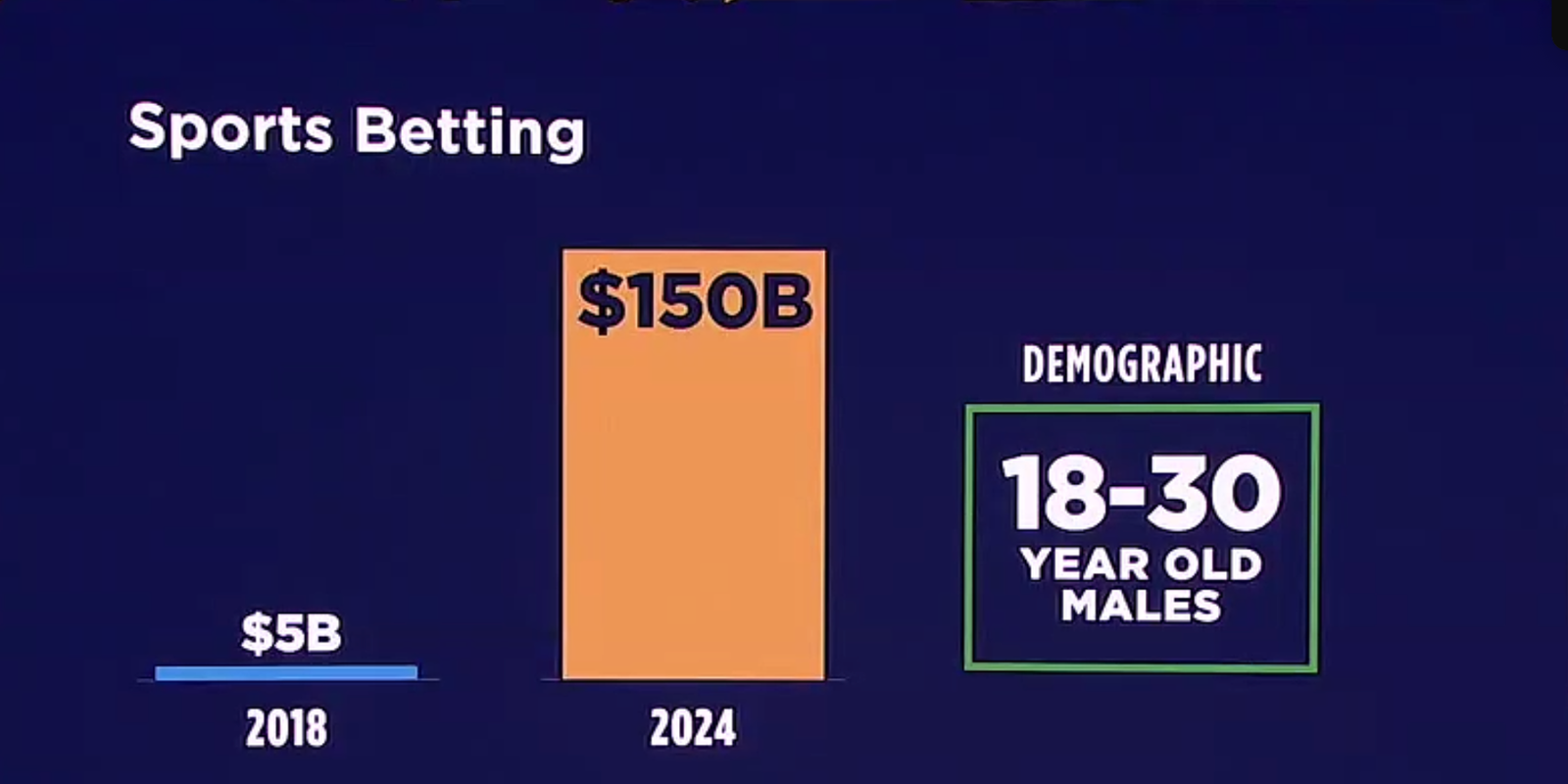

Parents want to help kids buy in because younger demographics spending money on..sports betting.

Adult children are supporting aging parents

Families are trading separate condos for one larger home

Cultural expectations and financial reality line up

Done well, it can:

Lower per-person housing costs

Make childcare or elder care easier

Keep family close in a city where distance matters

Done poorly, it can:

Strain privacy and relationships

Overload a house that’s too small or poorly laid out

Feel like a “temporary solution” that never gets revisited

For some, multi-gen living is the bridge that makes a 2026 move possible — either into a bigger shared home or into a property with a flexible suite.

What This All Means for Your 2026 Strategy

Think of 2025 as the set-up year and 2026 as the decision year.

Families are trading separate condos for one larger home

Cultural expectations and financial reality line up

Done well, it can:

Lower per-person housing costs

Make childcare or elder care easier

Keep family close in a city where distance matters

Done poorly, it can:

Strain privacy and relationships

Overload a house that’s too small or poorly laid out

Feel like a “temporary solution” that never gets revisited

For some, multi-gen living is the bridge that makes a 2026 move possible — either into a bigger shared home or into a property with a flexible suite.

What This All Means for Your 2026 Strategy

Think of 2025 as the set-up year and 2026 as the decision year.

Expect a more balanced market, not a frenzy.

You’ll likely see more listings as renewals bite and some “rate-locked” owners finally decide to move.

Competition may be strongest where repeat buyers and later-life first-timers overlap (good homes in livable, established neighbourhoods).

Use 2025 to:

Clean up debt and strengthen your file

Get clear on neighbourhood, budget, and must-haves

Decide if you’re okay with multi-gen, a suite, or a longer commute

If You’re Selling in 2026

In a 2019-style market, the winners are not the ones who shout the loudest — they’re the ones who are prepared and realistic.

You’ll want to:

Price to where the buyers actually are, not where you wish the market was

Decide if small renos or staging will meaningfully change your outcome

Think about your next home first, not last — especially if you’re downsizing or moving closer to family

If You’re a Move-Up Buyer

You’re in a unique position:

You might be “rate-locked” but space-locked too — the house or townhouse simply doesn’t fit your life anymore.

A balanced market lets you time the sell and buy with less chaos.

Your key questions:

Do I sell first or buy first?

Do I trade up in the same neighbourhood, or move to a different one?

Do I value space, school catchments, commute, or lifestyle most?

These are 2025 conversations that set up a smart 2026 move.

The Quiet Advantage: Having a Real Estate Advisor in a Calm Market

When the market is loud, everyone pays attention. When the market is calm, the prepared quietly win with the right agent.

A good real estate advisor isn’t just opening doors. They’re:

A connector in the community — seeing who’s thinking of selling before the sign goes up

An early-warning system for what’s coming next, not just what’s already sold

A filter that helps you avoid: buying the wrong home for your next 10 years, selling too quickly or too late , over-renovating the wrong property , missing red flags in strata docs or inspections

The real value isn’t in finding “a deal.” It’s in avoiding the regrets you only see once the dust settles.

If you’re thinking, “2026 might be our year to make a move,” the most useful step now is not a rush to list or buy — it’s a clear plan.

Thinking about a move in 2026? Use 2025 to get your strategy straight — whether that means staying and renovating, going multi-gen, or making a clean move-up or downsize. A 20–30 minute planning conversation can often save you months of second-guessing later.