Should I rent or buy a home in Vancouver right now?

With home prices still at historic highs and rental rates steadily climbing, making the right choice depends on more than just numbers. It’s about your goals, your lifestyle, and where you want to be in 5 to 10 years.

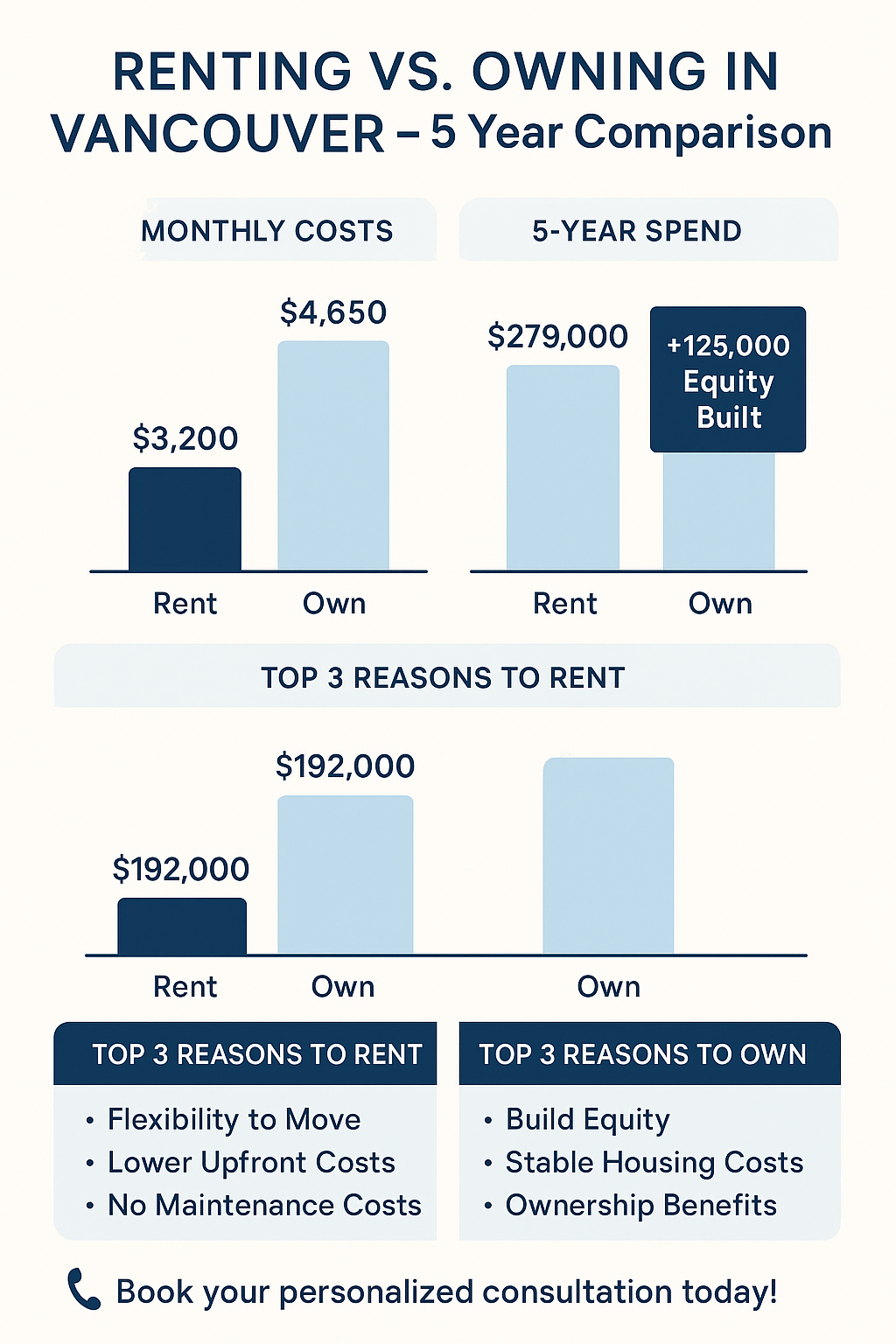

📍 Renting vs Owning in Vancouver: Quick Snapshot

Upfront Costs | 1st month + deposit vs. 5–20% down payment + closing costs |

Monthly Costs | Rent + tenant insurance vs Mortgage + property taxes + strata |

Flexibility | High – easier to move vs. Low – property sale needed |

Flexibility | High – easier to move vs. Low – property sale needed |

Equity Growth | None renting vs Builds over time |

Maintenance| Landlord handles vs. Homeowner responsibility |

Maintenance| Landlord handles vs. Homeowner responsibility |

Stability | Subject to rental increases vs. Fixed mortgage payments (if fixed) |

💰 Let’s Talk Real Numbers: Example for 2025

Here’s a look at the real numbers for a 2-bedroom condo in Vancouver, valued at approximately $900,000:

Expense Type | Renting | Owning (20% down) |

Monthly Rent | $3,200

Mortgage Payment | $3,800

Property Tax | $250

Strata Fees | $500

Maintenance Fund | $100

Property Tax | $250

Strata Fees | $500

Maintenance Fund | $100

Total Monthly $3,200 vs $4,650 ( owning) Renting is cheaper. But the long-term picture tells a different story.

📈 5-Year Projection: Renting vs. Owning

Total Rent Paid (5 years)vs . Total Homeowner Costs (5 years)+ Equity Built (Estimate)

Rent $192,000 vs. Own $279,000 | $125,000+ equity gain

While homeownership requires more upfront commitment, it also builds long-term wealth through equity, appreciation and stability.

✅ Why Renting Might Be Right for You

Planning to move or change careers soon

Saving for a larger down payment

Unsure if Vancouver is your long-term home

✅ Why Buying Might Be Right for You

Ready to settle and build wealth over time

Want to lock in predictable housing costs

Prefer ownership and control over your living space

Buying a home in Vancouver isn’t for everyone—but if you’re planning to stay for 5+ years, homeownership is often the smarter long-term financial move.

It’s not about chasing headlines—it’s about your goals, time your life not time the market.

📞 Let’s Map Out Your Next Move

Whether you’re ready to buy or just want to explore your options, I’m here to help you build a plan that fits your life and your budget.